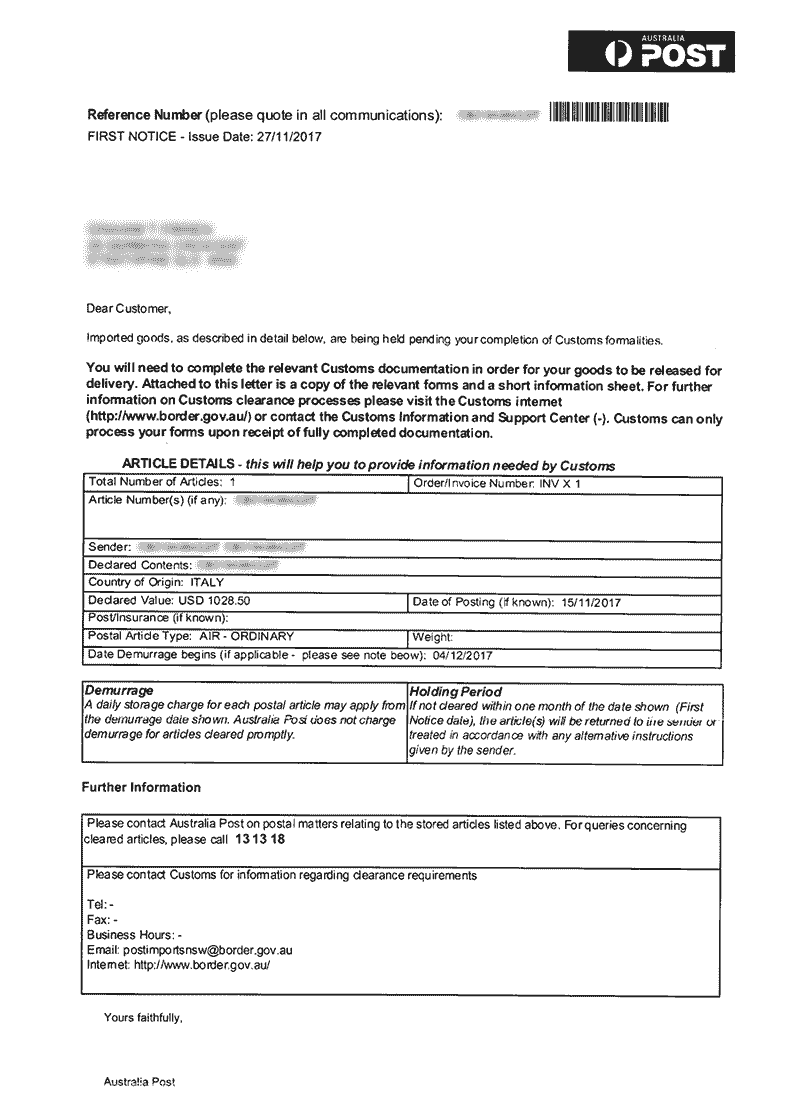

If you do not have a Receipt or Commercial invoice,

please download this document to make your Personal Declaration.

Goods ‹ $1,000 = Nil (Conditions apply)

Goods > $1,000 = 5% Duty, 10% GST + $83 Gov Fee

Goods > $10,000 = 5% Duty, 10% GST + $152 Gov Fee

We Guarantee Duty Minimisation for 4 years.

Duty and/or GST exemptions may apply.

Over 82% of Import trade into Australia, can potentially gain duty free entry.

As a guide, if duty were to apply, allow 5% Customs Duty + 10% GST (excluding excisable goods such as alcohol and tobacco products, which attract higher fees based on weight / litres).

Duty Is calculated on the price paid for your goods, plus any costs to get your items to the airport in country of origin. Convert these charges to Australian dollars with the exchange rate for the day your goods left the Country of Origin, as this is the amount you pay your duty % on. GST is charged @ 10% on the Cost of Goods + Freight + Insurance + Duty.

At times, additional charges for clearance services may apply.

Australian Customs Clearance are the experts in Air Freight Customs Clearance and are based at all major international airports across Australia including Sydney, Brisbane, Gold Coast, Perth, Adelaide, and Melbourne Tullamarine.

Our Air Freight Customs Clearance agents will clear your air cargo quickly and efficiently, saving you time and money. When you submit your Air Waybill and supplier's invoice online, our customs brokers streamline the process AND minimise any duty or GST payable. Once your air freight has been lodged with Customs, you'll receive an email notification with collection instructions. It's that easy!

While shipping goods by air might seem relatively straight forward, the air freight customs clearance process once they have arrived in Australia is more complex. The advantage of using Australian Customs Clearance, is that we take care of the red tape for you. Our Customs agents can provide expert advice upon request; alternatively, you can fill in the online form as the first step towards getting your air freight released from Customs. Once you've provided all the information about the imported goods, as well as personal details and consignment information, a customs agent will assess your cargo and minimise any duties/GST and charges payable. At Australian Customs Clearance, we provide fast, professional service that makes Customs Clearance easy.

Yes. Storage charges apply 24hrs after midnight on the day of cargo check-in. Storage rates differ slightly, but as a guide, Qantas charges AU$0.33/kg/day and a minimum of AU$48.40/day.

You will receive a 'notification of release' email once the Customs clearance process is complete. The notification provides valuable information regarding airline bonds collection, including the contact details and the address for the local office. Upon arrival, you will be required to pay any port charges payable after which you will receive your collection slip.

You will be directed to the pick-up dock where you will need to present the collection slip/docket to have your consignment recovered from the bond. A forklift operator will assist you to load your goods onto your vehicle. Smaller consignments must be broken down personally for loading into your own vehicle.