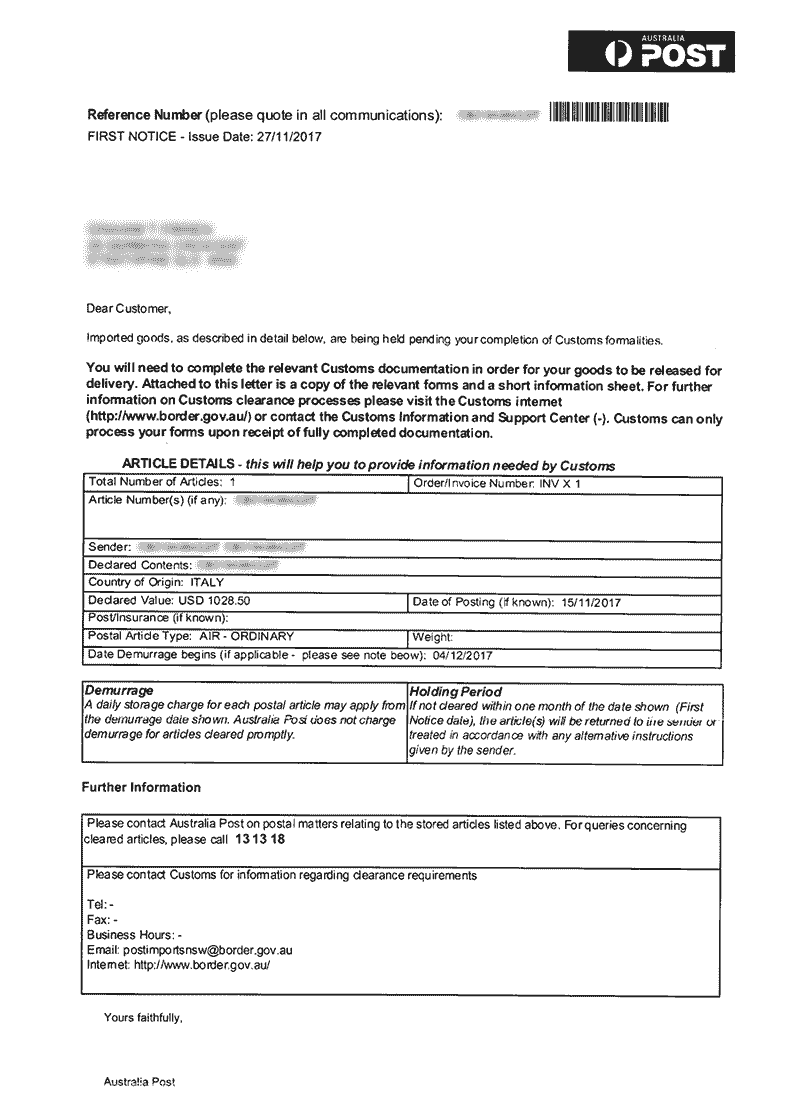

Australia Post

If you do not have a Receipt or Commercial invoice,

please download this document to make your Personal Declaration.

$50 Processing/Gov. Entry Fee

We Guarantee Duty Minimisation for 4 years.

Duty and/or GST exemptions may apply.

Over 82% of Import trade into Australia, can potential gain duty free entry.

As a guide, if duty were to apply, allow 5% Customs Duty + 10% GST

Excluding Excisable goods such as Alcohol and tobacco products.

Additional charges for clearance services.

Submit your documentation online and allow ACC to take care of the rest. Your goods will be assessed and through our ‘Duty Minimisation Guarantee’ we will minimise any duty payable wherever legally possible. Declarations are lodged electronically with Customs and your imports cleared within four hours. Australia Post completes the process and delivers your goods to your door.

Goods imported into Australia are liable for Duty/GST. The Goods and Service Tax is now applicable to low value imports and goods valued at AU$1000 or less now incur GST. *Duty/GST still applies to alcoholic beverages, tobacco, tobacco products etc, no matter their value. If you are importing goods into Australia with a value over AU$1000, you will be required to complete a Customs declaration and must pay all due duties, taxes and charges. Once payment is received your goods will be released from Customs hold and Australia Post will schedule delivery of your goods.

ACC can help with all your import Customs clearance needs.